Digitally transforming financial regulation in paradise

Facing a massive increase in their catchment and remit after a change in law, The Barristers & Accountants AML ATF Board of Bermuda had a problem. How could their small team double the number of financial regulation inspections they were carrying out while still maintaining check quality? The board turned to Browser for help.

As the regulatory authority governing legal and accounting sectors within Bermuda, The Barristers & Accountants AML ATF Board is responsible for the detection and prevention of money laundering and terrorist financing within the country.

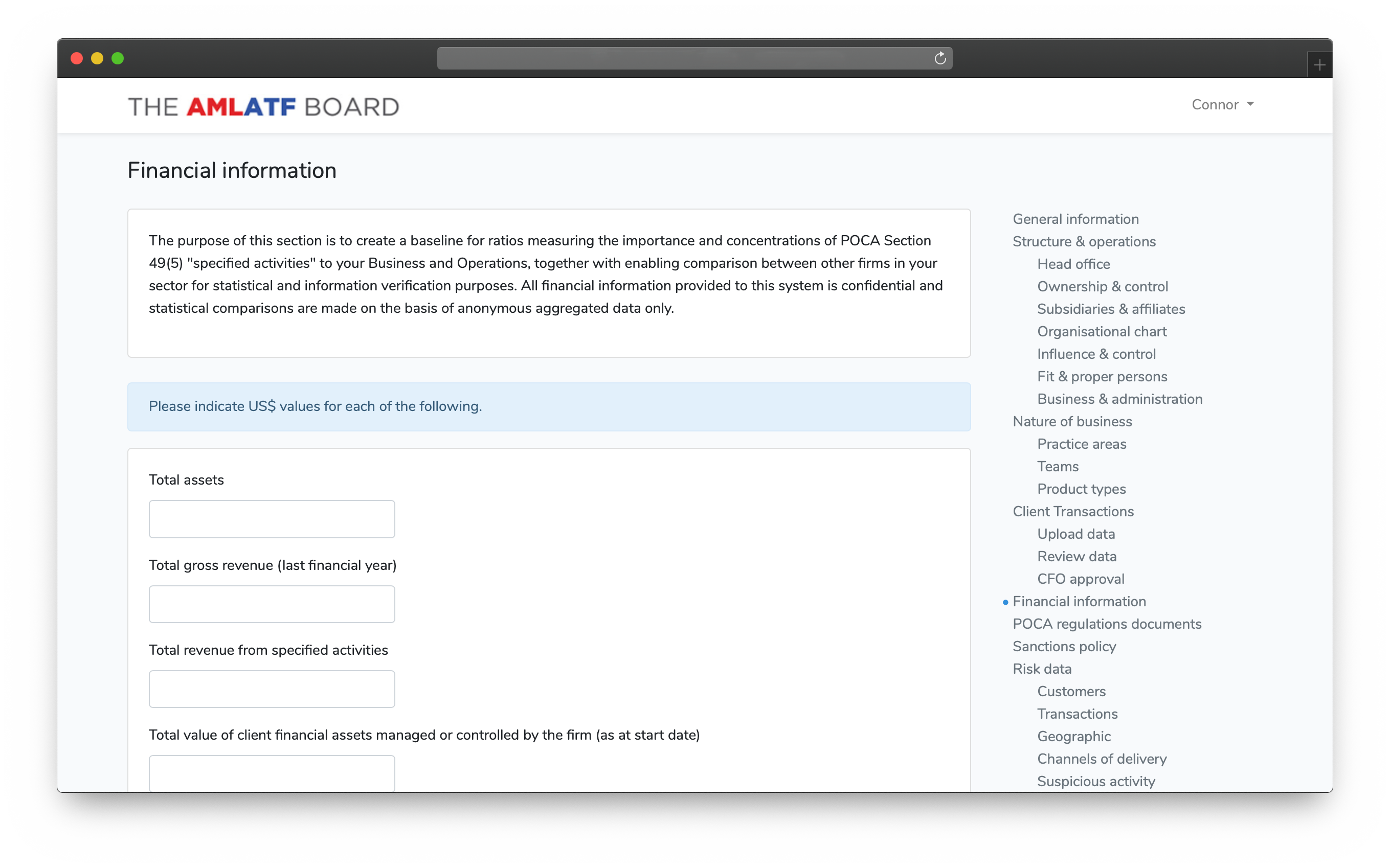

Prior to the law change, the board’s financial regulation checks were largely paper-driven; regulated entities filled out forms by hand and mailed them in to be processed. The organisation knew this needed to change, but needed help designing, building and developing a future roadmap for the semi-automated, online system that they envisaged.

The brief also highlighted the strict security and server location requirements of the platform, given the highly sensitive nature of the data users would be submitting.

The discovery phase

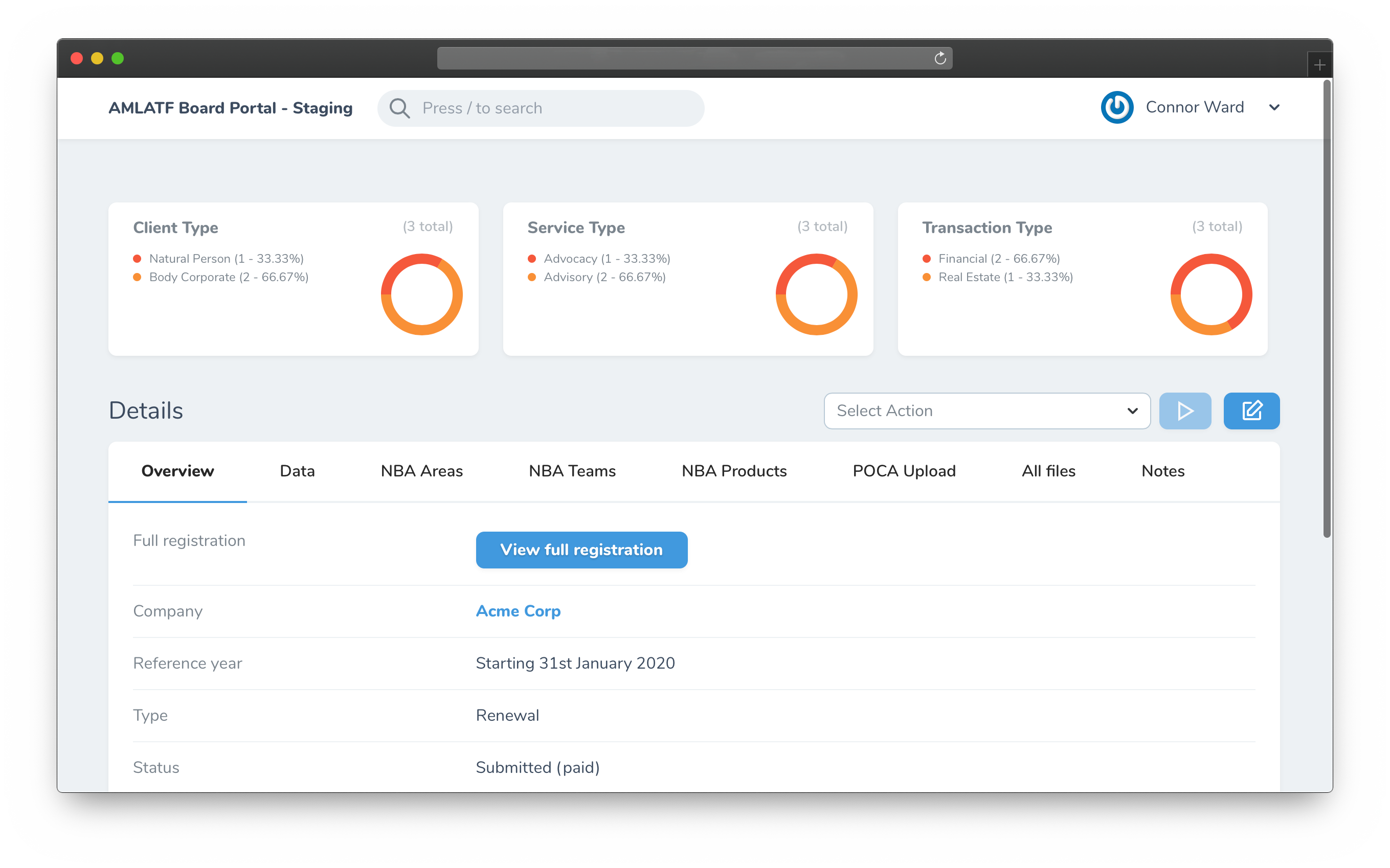

The engagement started with a short discovery phase to firm up the functional brief. We also used this time to explore the UX and UI options available to the product to make sure we were leveraging the data visualisation opportunities that digitising and standardising the data submission process would bring.

The benefits of getting this right were clear to the client. For example, the board saw the opportunity to standardise the language used across regulated sectors, as this would allow the team to carry out intra-sectoral comparisons and risk flagging, bringing benefits in terms of regulatory accuracy and crime detection.

Building the financial regulation platform

With the technical structure, data hierarchy and UX of the platform defined more tightly, we moved onto the build stage of the project.

Here, we employed Amazon Web Services (AWS) and it’s attendant suite of services, including S3 to manage and scale storage and ECS to enhance security through containerisation, allowing us to meet the client’s security and server location requirements.

The customer-facing, front-end of the platform was kept as simple as possible, making it easy for customers to upload a standardised transactions spreadsheet. Once uploaded, the platform ingests the data and catalogues the transactions into a database (based on Amazon RDS) employing Redis (ElastiCache) to boost performance.

Once catalogued, the platform rapidly interrogates the data (using scalable EC2 compute resource), flagging suspect transactions through simple pattern and phrase matching for later human review. To aid efficiency, the platform even signals which part of the law the transaction is likely to relate to, shortening assessment time for analysts.

Original data visualisations give the regulatory team at-a-glance trends and metrics, which simply weren’t possible with a paper record approach. These can be broken down further by sector or entity, giving the board quick information about transaction mix, allowing them to make detailed determinations about what a company or regulated entity is doing.

The future

Now in final beta testing, the platform will be in use by The Barristers & Accountants AML ATF Board of Bermuda for all company registrations in 2021. It’s anticipated that as well as allowing the board to process more checks, the platform will also make the mitigation activities of Bermudan firms more efficient and effective, saving them time.

Looking further ahead, there is a full pipeline of future development options for the platform. For example, we’ll be looking into the feasibility of adding Natural Language Processing (NLP) technology into the system to help with the categorization and filtration of data. Additionally, if the system works well, then there is scope to use it as a basis for other paper-driven regulatory checks that the body carries out, such as fit and proper person checks.